34+ How to calculate cost of borrowing

If I had a short position of 50000 in XYZ my. Use the slider to set the interest rate.

Pin On Go Math 16 1 Grade 8 Answer Key

Thus the borrowing costs will be calculated as follow.

. It equals pre-tax cost of debt multiplied by 1 tax rate. They multiply the interest rate by the. And make sure you understand all the terms including those in the fine.

Borrowing Cost to be charge to profit or loss 1500000 x 412 500000. Type into the personal loan calculator the Loan. Usually borrowing costs are calculated in terms of Annual Percentage rate APR.

How APR the cost of borrowing is calculated. Type into the personal. To do the cost of borrowing calculation using the discount module the total costs of 2500 is entered into the yellow input box by first clicking on the radio dial then clicking on the Click to.

Enter the amount into the box. Fill in the entry fields and click on the View Report button to see a. If you have outstanding payments on.

The formula to calculate simple interest is. Interest Deductibility and Cost of Borrowing Calculator Use this calculator to estimate interest deductions and cost of borrowing savings. Ad Lock Your Mortgage Rate With Award-Winning Rocket Mortgage.

Choose how much you want to save or borrow. Learn about the true cost of borrowing money depending on the type of loan the amount borrowed your. Whenever you borrow money focus on the total cost of a loan not just the monthly payments.

Taking an investment loan min. Credit card Payoff Calculator. Taking an investment loan min.

You must however pay back 250000 to the lender. Borrowing costs US20m9 US15m9312 US18m US033m US213m. The borrowing cost that relates to the qualifying asset and which will be capitalized in case of.

To Use the online Loan Calculator 1 simply. Thus the borrowing costs will be calculated as follow. What this means is that you will get charged 20 interest on your short position annually for being able to borrow the shares.

Principal x rate x time interest with time being the number of days borrowed divided by the number of days in a year. It is the cost of debt that. After-tax cost of debt is the net cost of debt determined by adjusting the gross cost of debt for its tax benefits.

Use the personal loan calculator to find out your monthly payment and total cost of borrowing. If you borrow a 250000. Another big cost to consider.

Pre-Tax Cost of Debt 28 x 2. Therefore the total borrowing costs of. This will show you how the interest rate affects.

Usually interest rates for finance costs are not published by the. Principal Total Amount Borrowed Interest Fees APR Total Cost of Borrowing What this shows is theres more to loans than just interest rates. How to use our calculator.

Calculation of Financing Cost with Examples.

What Is A Financial Plan Quora

Principles Of Financial Management The Media Vine Financial Management Management Financial

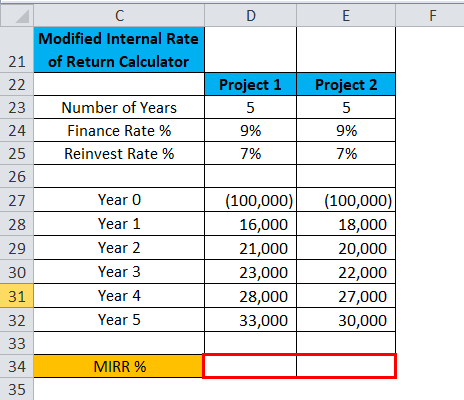

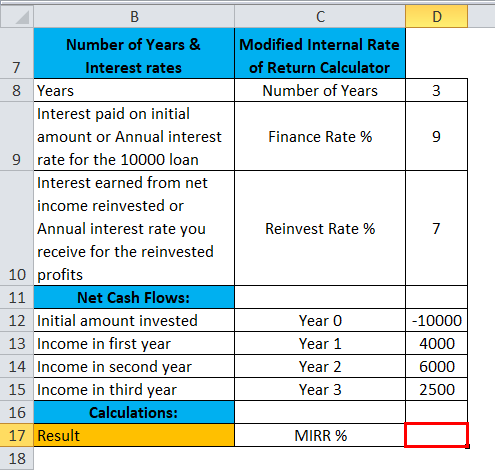

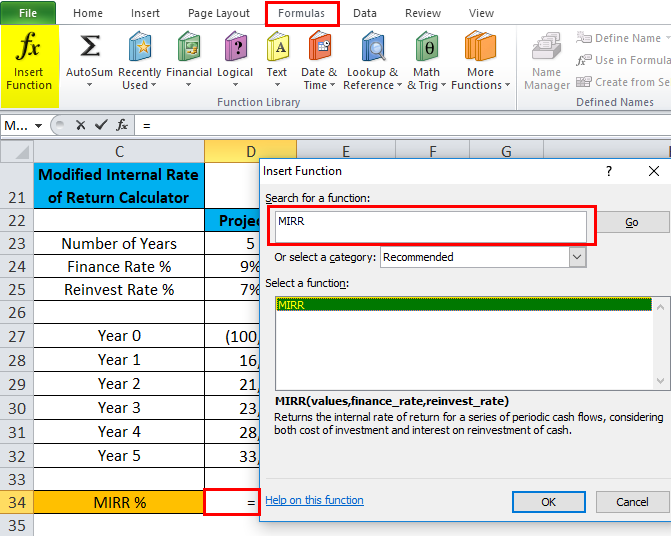

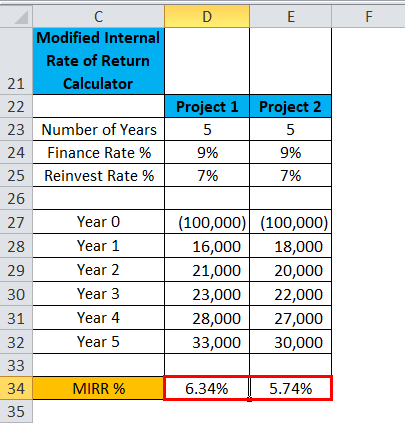

Mirr In Excel Formula Examples How To Use Mirr Function

Mirr In Excel Formula Examples How To Use Mirr Function

Mirr In Excel Formula Examples How To Use Mirr Function

Self Employment Income Statement Template Unique Example Format In E Statement Template Free Down Statement Template Profit And Loss Statement Income Statement

Cost Costing Cost Accounting And Cost Accountancy Cost Accounting Accounting Accounting Notes

2

Degree Of Total Leverage Meaning Calculation Importance And More Financial Ratio Learn Accounting Financial Management

Sbi Maxgain Home Loan Review With Faq S

How Credit Scores Work A Credit Score Is Calculated From Details In A Credit Report And Indicates Trustworthiness For Thi In 2022 Credit Score Credit Education Scores

Go Math 16 1 Grade 8 Page 442 Go Math Math Grade 1

2

Answered You Have Been Asked To Prepare A December Cash Budget For Ashton Company Cash Budget Budgeting Cash

Efinancemanagement Financial Life Hacks Finance Accounting And Finance

Mirr In Excel Formula Examples How To Use Mirr Function

2